New Market Tax Credits

As a nationally recognized expert, Endeavour actively works on and consults on New Markets Tax Credit (NMTC) deals. When we serve as a consultant on NMTC deals, each client - both for-profit and non-profit - receives the full collaborative effort of the firm’s wide-ranging national experience and partner network.

What are New Market Tax Credits?

The New Markets Tax Credit (NMTC), passed by Congress with bipartisan support in December 2000, is the most significant federal subsidy for economic development of depressed areas in thirty-five years. Designed to stimulate the flow of investment capital into underserved areas, it is intended to bring about the direct investment of at least $30 billion into these areas over a twenty-year period. Ideally, it is likely to eventually leverage two to four times the additional investment amount.

In the form of credits against federal taxes provided to investors as an incentive to invest in economically-distressed areas where capital has not been available.

Include everything from manufacturing and service businesses, to commercial and industrial projects such as retail real estate developments, office buildings and warehouses, mixed-use commercial and housing developments, to community facilities such as child care centers and charter schools.

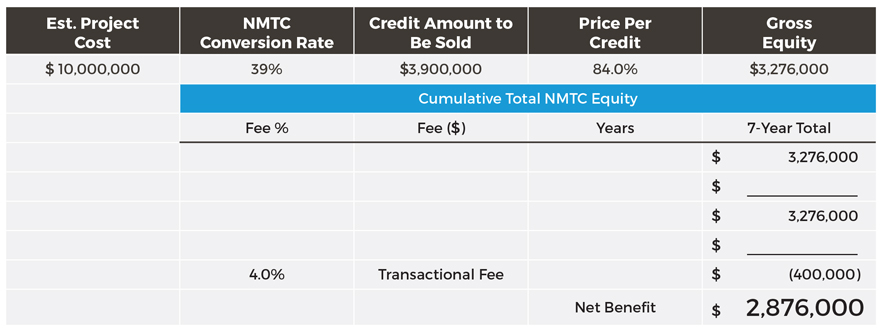

In a typical NMTC deal, a project owner can expect roughly 25% of the total capital required to be funded through the NMTC program. A sample worksheet can be seen below. We would be happy to walk you through this and help you determine the substantial economic benefit you could expect from NMTCs on your project. Just call us: 414-331-1939.

Given today’s financial landscape, NMTCs can make the difference in closing your project.

Contact Endeavour to see how you might secure NMTCs for your next deal.

New Markets Tax Credit Federal Resources:

Looking for Real Estate Partners You Can Trust?

330 E. Kilbourn Avenue, #1160, Milwaukee, WI 53202

© 2016, Endeavour Corporation, Inc. All rights reserved.